The Blog

post index

Read this post →

As a business owner, you may be wondering why you need to gather statements to do your bookkeeping. After all, can’t you just do it all in your head? We’re here to tell you that yes, gathering statements is an important part of bookkeeping—and we’ll tell you why. 1. To keep track of your spending. […]

Read this post →

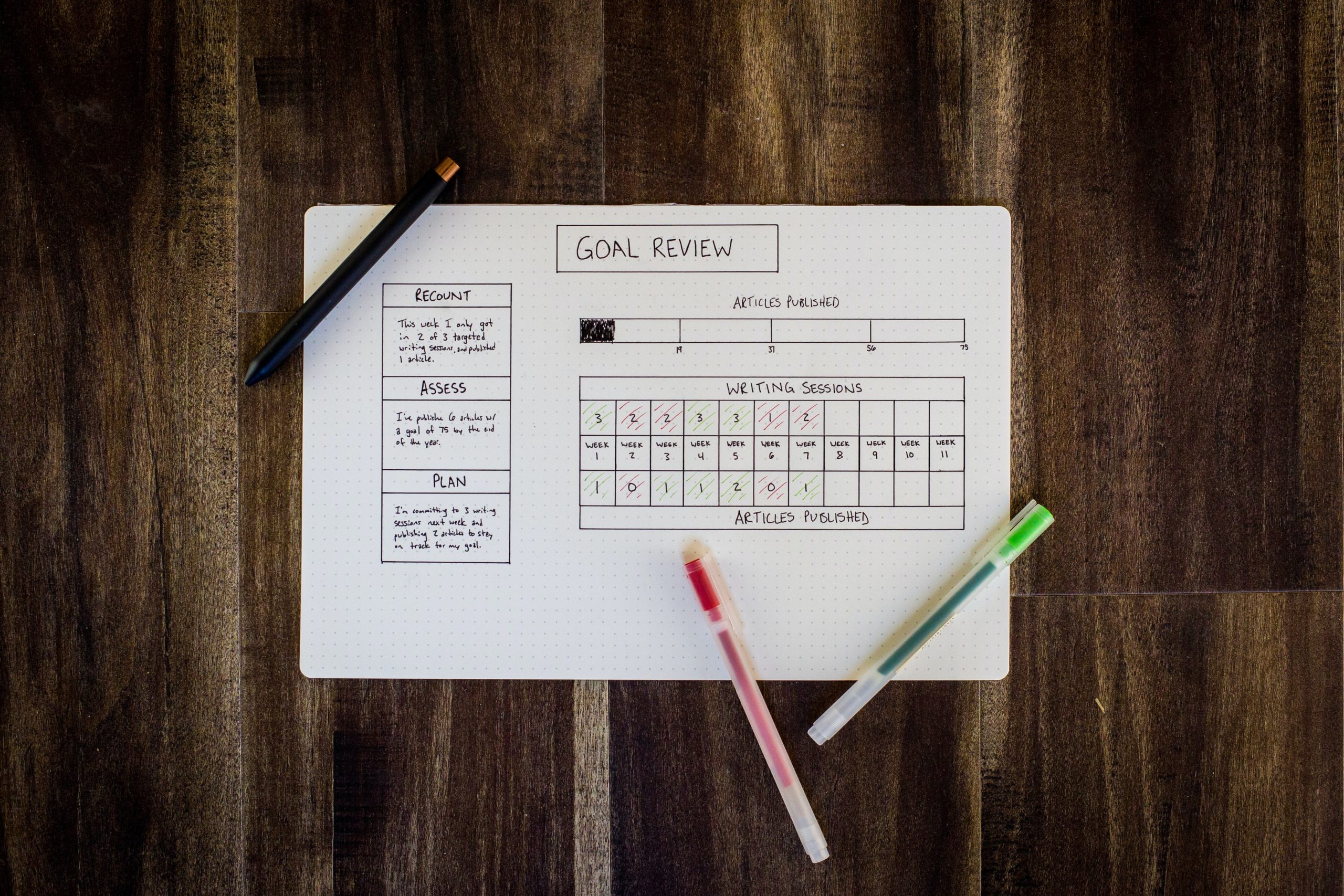

One of the most important—but often overlooked—aspects of running a successful business is setting and achieving financial goals. Without a clear idea of what you want your business to achieve financially, it’s difficult to make sound decisions that will move your business forward. Fortunately, setting financial goals is not as difficult as it may seem. […]

Read this post →

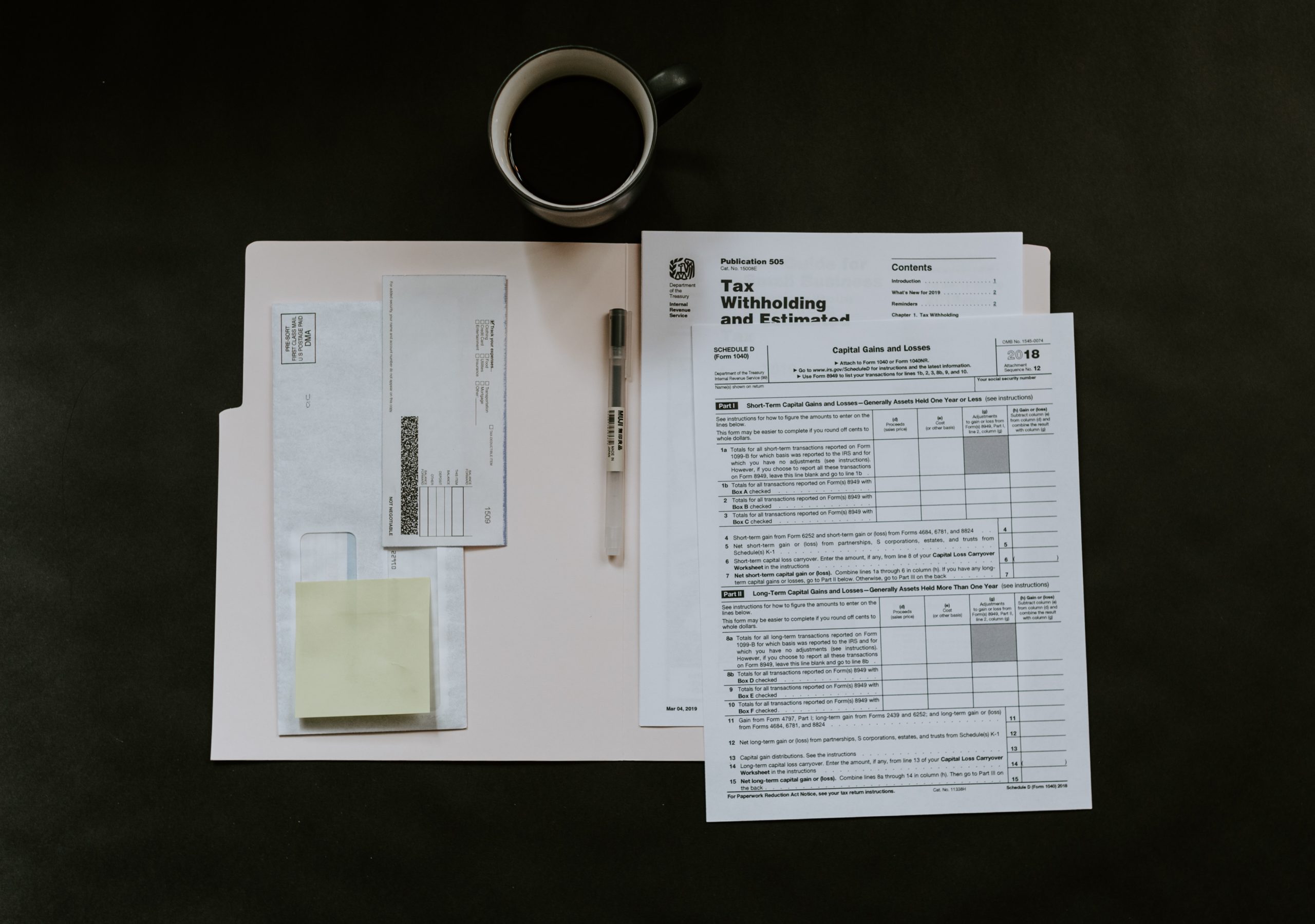

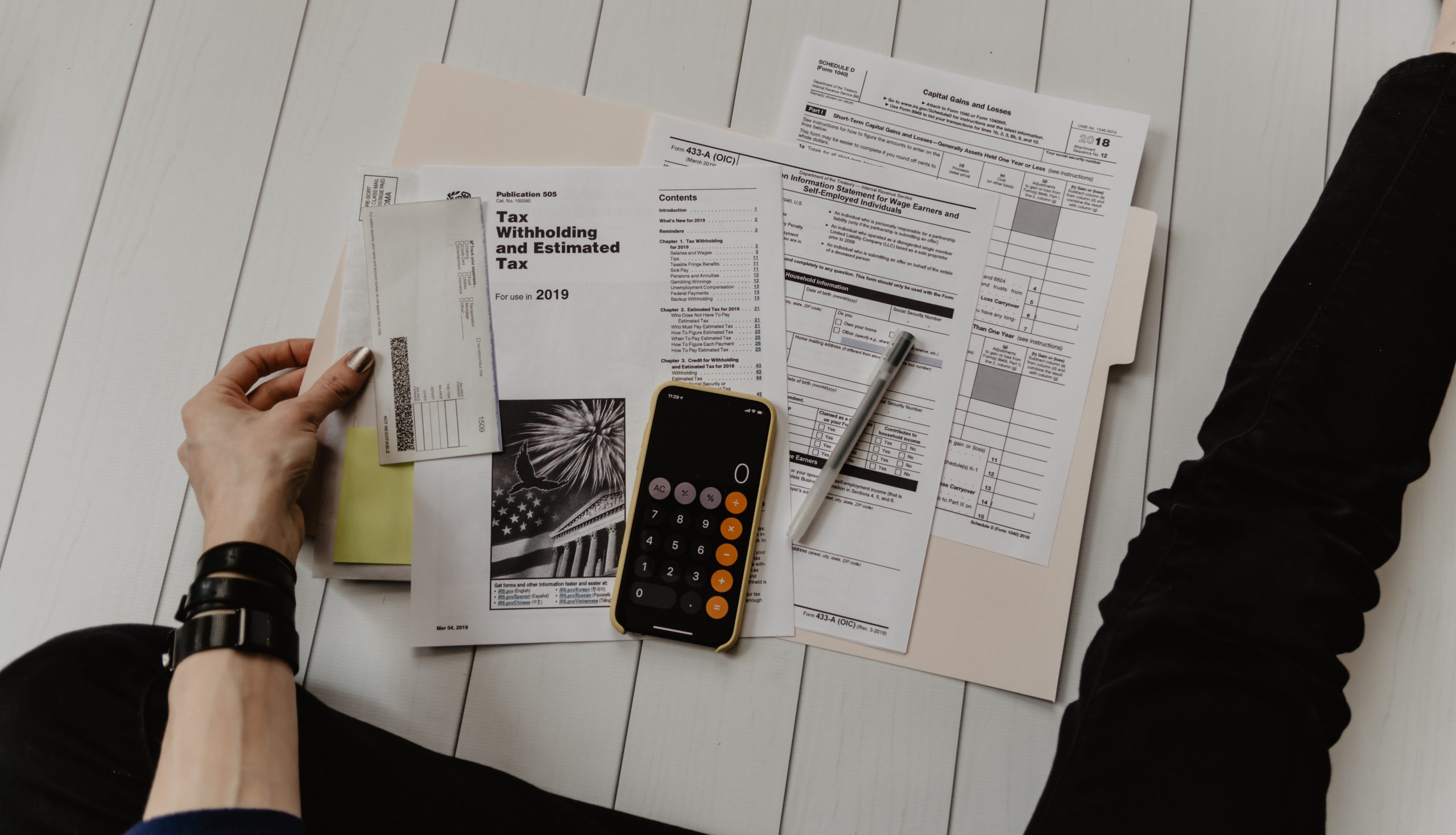

If you are self-employed, you are probably used to handling your own taxes come April. But did you know that as a business owner, you are also responsible for making estimated tax payments throughout the year? Estimated taxes are essentially pre-payments for your annual tax liability, and are typically due four times per year. In […]

Read this post →

The 1099-NEC form is for businesses who have paid contractors more than $600 for services rendered. This form is filed with the government by January 31st and must be sent to the individual contractor as well as the government. In this blog post, we will break down everything you need to know about the 1099-NEC […]

meet the blogger

Hey there!

Before you get any further...

Hi! I'm Marinda Broadbent!

I’m an expert QuickBooks Online Bookkeeper, a nerd when it comes to the

A small town Idaho bookkeeper, educator and mom 3 girls, my happiest days are spent behind my computer working on clients books. I'm glad you're here.

numbers, and my obsession is teaching business owner their numbers so be confident on grow their business (without it taking over their life).